Date:Thu Apr 25 2024Tokyo:6:51Sydney:7:51New York:17:51London:22:51CET:23:51

BinaryOptions.net Forums› Brokers

Options

Cantor Exchange

binaryoptionstutor Posts: 23 ✭

Posts: 23 ✭

in Brokers

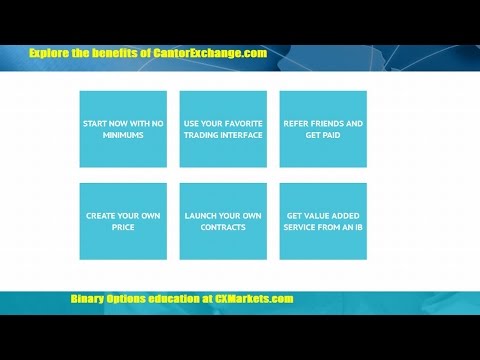

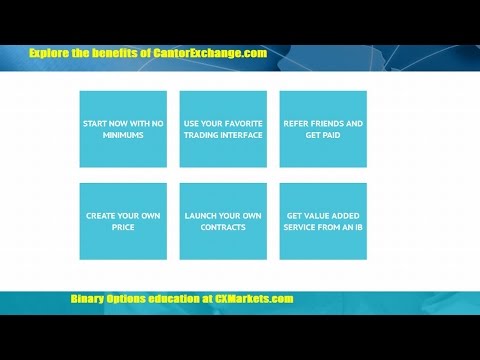

I thought I would start a thread about Cantor exchange here with some of what is going on with that exchange. Firstly let me be perfectly clear and transparent. My brother and I are going to offer independent education for the exchange. That is no secret and you can see our names mentioned here.

http://www.financemagnates.com/binary-options/brokers/cantor-exchange-launches-new-educational-website-cx-markets/

and on their educational website here:

http://www.cxmarkets.com/helpful-resources/educators/

I am not presently a referring participant but my brother wants to be and that means at a point I will probably give in. I just want to get it out of the way and be clear. I have been watching this exchange for some years and I like what they are trying to do so we are supporting them because we believe in it. In my opinion Cantor exchange is probably the best place right now to learn to trade Binary Options in the 0-100 format like here in the states.

1. There are micro contracts at $1

NOTE: You can manage how much you risk better this way. You can start learning by trading a live account but not risking $80-$90 for ITM contracts

2. They will let anyone get API access: Means you can automate your stuff and or get fast execution without a $500-$1000 access fee or required volume of trades.

The liquidity is getting better every week there IMO and some USA people who are familiar with platforms like SpotOption( TradeRush),Techfinancial ( 24Options ) or Tradologic ( Optionbit ) will be able to trade there on these platforms at a point in the future. Here is a video I done recently about their educational site and showing an end of day trade based on simple logic.

https://www.youtube.com/watch?v=COne50zqrGU

https://www.youtube.com/watch?v=COne50zqrGU

Right now they only have

5M,20M 1H and EOD Expire times but I am hearing they are going to start letting participants launch their own expire times and strikes soon.

http://www.financemagnates.com/binary-options/brokers/cantor-exchange-launches-new-educational-website-cx-markets/

and on their educational website here:

http://www.cxmarkets.com/helpful-resources/educators/

I am not presently a referring participant but my brother wants to be and that means at a point I will probably give in. I just want to get it out of the way and be clear. I have been watching this exchange for some years and I like what they are trying to do so we are supporting them because we believe in it. In my opinion Cantor exchange is probably the best place right now to learn to trade Binary Options in the 0-100 format like here in the states.

1. There are micro contracts at $1

NOTE: You can manage how much you risk better this way. You can start learning by trading a live account but not risking $80-$90 for ITM contracts

2. They will let anyone get API access: Means you can automate your stuff and or get fast execution without a $500-$1000 access fee or required volume of trades.

The liquidity is getting better every week there IMO and some USA people who are familiar with platforms like SpotOption( TradeRush),Techfinancial ( 24Options ) or Tradologic ( Optionbit ) will be able to trade there on these platforms at a point in the future. Here is a video I done recently about their educational site and showing an end of day trade based on simple logic.

https://www.youtube.com/watch?v=COne50zqrGU

https://www.youtube.com/watch?v=COne50zqrGURight now they only have

5M,20M 1H and EOD Expire times but I am hearing they are going to start letting participants launch their own expire times and strikes soon.

Tagged:

Comments

Hit me up on skype at Brymcafee (McAllen TX)

www.tradingaxis.com

My question is does cantor work like a Dealing desk to help liquidity, ie do they take opposite positions of the trader to pump liquidity.

I hate to say it but I would love to see Lotz try you all out he is great at spotting shit like that, he has like a 2nd sense for it.

If they do not I would probably help drag people in as the platform was not to bad, NADEX is a nightmare and money management for a smaller trader is a joke.

If you do trade cantor a lot why not start a thread here so people can see how it works I would love to see it.

Bryan

Hit me up on skype at Brymcafee (McAllen TX)

www.tradingaxis.com

Hit me up on skype at Brymcafee (McAllen TX)

www.tradingaxis.com