EUR/USD Trading (January 5, 2015)

mifune

Posts: 160 ✭✭

I posted a few recent posts in my strategy/charts thread in the "Trading Journals" part of the forum. But with all the images on each page, the loading time can be somewhat long, so I decided to place this in a thread of its own.

Although I had been actively trading between the Christmas and New Year's holidays, no viable trades set up in the way I wanted them to. I simply sat in my chair monitoring the charts (though not directly, just through setting alarms that trigger if price hits a certain point) for about eighteen hours over the three days I dedicated to trading. It was without a doubt the longest stretch I had gone without actually taking a trade. But going 0/0 is much better than hitting at a low percentage that loses money.

Of course, trading volume tends to be rather low between December 25 and January 1, given many are on holiday and volume in the market simply isn't very high. As a consequence, the mediocre market movement doesn't lend itself very well to predictable trade or high-quality set-ups. Trades would surely start to introduce themselves when the market's volatility becomes more normal.

Perhaps the most surprising thing is the EUR/USD's continuous slide. The Euro came under renewed pressure just past the midway point of December and has fallen 700 pips since that point. The 1.2000 level figured to be a realistic psychological support and encounter a period of congestion, but that simply didn't occur. The EUR/USD fell swiftly below that point to reach lows that haven't been seen since January 2006.

Whatever the case, put options, for now, are your best bet on this pair given the strength of the current ongoing macro trend with this pair. Although I don't necessarily disqualify call options from consideration on this pair, I feel more comfortable taking the downside with all things considered.

My first trade came very early on this pair. Normally, I trade from 2AM EST to sometime within the U.S. morning, depending on how the market is developing and the time I personally have on hand. But occasionally I do look at the charts during the Asian session hours that precede the beginning of the European open, typically taken to be 2AM EST.

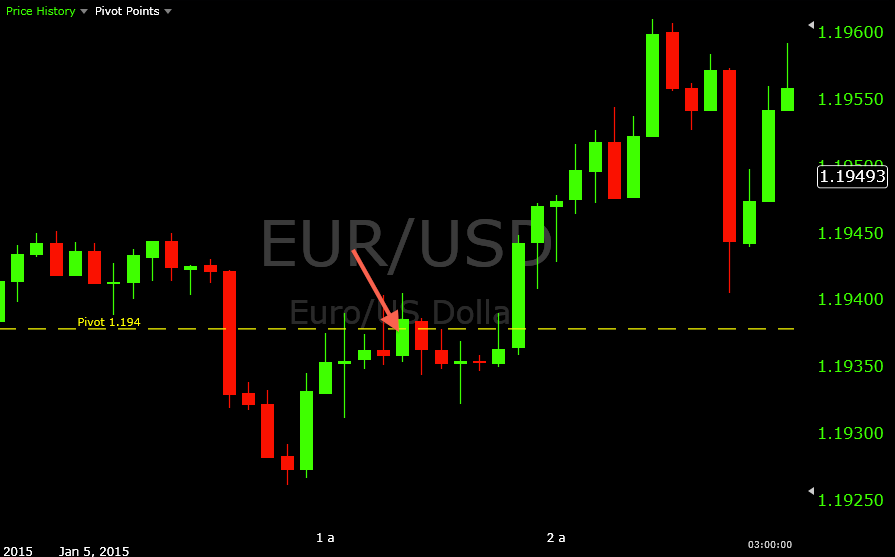

In this case, I saw price setting up along the 1.1938 daily pivot level. Price had been congesting in the area in the hours prior, and had dipped down below the level on the 12:35AM candle. Given the natural inclination toward put options, a test back up to this pivot point could possible set up a put option opportunity. As a result, it was worth keeping an eye on and I set an alert at 1.19330 so I could again check the charts if price decided to challenge the pivot level in the near-term.

It nearly hit the pivot on the 1:00 candle, actually did so on the 1:05, and re-touched on the 1:15. I had considered getting in on the 1:15 candle, but I wanted more confirmation in terms of letting the candle play out on the chart to see where it would finish (it did close below pivot, which is what I was looking for). Also, I would have felt a bit more comfortable in a shorter-term trade, instead of one longer than fifteen minutes.

I decided to get in on the 1:20 candle for a put option expecting the pivot level to hold as resistance. This trade went a couple pips out of favor on the entry candle before settling for nearly a three-pip winner by expiration.

Following, I had a couple set-ups that simply didn't materialize. Price held above the pivot and would have been a logical landing spot to see call option set-ups, especially given the earlier sensitivity that was shown to the level.

Price did touch down to the level on the 5:10 candle, but I was looking for a clear bounce off pivot to show that buyers were coming into the market at this point and forcing the market back up. Clearly there was a decent period of congestion around this area for 15-20 minutes, but it simply wasn't enough evidence to show that pivot would serve as support to offer a good call option trade. Once the 5:20 candle closed below pivot, it seemed like the bear market on the EUR/USD would simply supersede whatever buying effort was occurring. As a result, I turned my focus back to put options if a reasonable resistance area set up. Of course, the pivot could again certainly be a reasonable area for this.

I did wait on this market a little further, believing it could have potential to offer one final solid trade set-up, but unfortunately nothing was worth taking. As you can see in the image above, there was a net bearish ebb and flow to the market that would have probably been kind to put options at a clear area of resistance, but nothing set up so I closed things down for the day.

Although I had been actively trading between the Christmas and New Year's holidays, no viable trades set up in the way I wanted them to. I simply sat in my chair monitoring the charts (though not directly, just through setting alarms that trigger if price hits a certain point) for about eighteen hours over the three days I dedicated to trading. It was without a doubt the longest stretch I had gone without actually taking a trade. But going 0/0 is much better than hitting at a low percentage that loses money.

Of course, trading volume tends to be rather low between December 25 and January 1, given many are on holiday and volume in the market simply isn't very high. As a consequence, the mediocre market movement doesn't lend itself very well to predictable trade or high-quality set-ups. Trades would surely start to introduce themselves when the market's volatility becomes more normal.

Perhaps the most surprising thing is the EUR/USD's continuous slide. The Euro came under renewed pressure just past the midway point of December and has fallen 700 pips since that point. The 1.2000 level figured to be a realistic psychological support and encounter a period of congestion, but that simply didn't occur. The EUR/USD fell swiftly below that point to reach lows that haven't been seen since January 2006.

Whatever the case, put options, for now, are your best bet on this pair given the strength of the current ongoing macro trend with this pair. Although I don't necessarily disqualify call options from consideration on this pair, I feel more comfortable taking the downside with all things considered.

My first trade came very early on this pair. Normally, I trade from 2AM EST to sometime within the U.S. morning, depending on how the market is developing and the time I personally have on hand. But occasionally I do look at the charts during the Asian session hours that precede the beginning of the European open, typically taken to be 2AM EST.

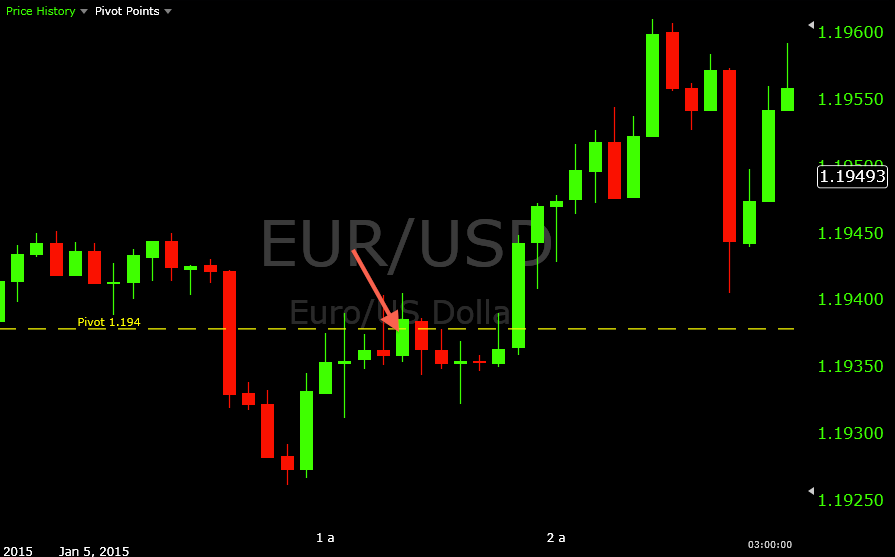

In this case, I saw price setting up along the 1.1938 daily pivot level. Price had been congesting in the area in the hours prior, and had dipped down below the level on the 12:35AM candle. Given the natural inclination toward put options, a test back up to this pivot point could possible set up a put option opportunity. As a result, it was worth keeping an eye on and I set an alert at 1.19330 so I could again check the charts if price decided to challenge the pivot level in the near-term.

It nearly hit the pivot on the 1:00 candle, actually did so on the 1:05, and re-touched on the 1:15. I had considered getting in on the 1:15 candle, but I wanted more confirmation in terms of letting the candle play out on the chart to see where it would finish (it did close below pivot, which is what I was looking for). Also, I would have felt a bit more comfortable in a shorter-term trade, instead of one longer than fifteen minutes.

I decided to get in on the 1:20 candle for a put option expecting the pivot level to hold as resistance. This trade went a couple pips out of favor on the entry candle before settling for nearly a three-pip winner by expiration.

Following, I had a couple set-ups that simply didn't materialize. Price held above the pivot and would have been a logical landing spot to see call option set-ups, especially given the earlier sensitivity that was shown to the level.

Price did touch down to the level on the 5:10 candle, but I was looking for a clear bounce off pivot to show that buyers were coming into the market at this point and forcing the market back up. Clearly there was a decent period of congestion around this area for 15-20 minutes, but it simply wasn't enough evidence to show that pivot would serve as support to offer a good call option trade. Once the 5:20 candle closed below pivot, it seemed like the bear market on the EUR/USD would simply supersede whatever buying effort was occurring. As a result, I turned my focus back to put options if a reasonable resistance area set up. Of course, the pivot could again certainly be a reasonable area for this.

I did wait on this market a little further, believing it could have potential to offer one final solid trade set-up, but unfortunately nothing was worth taking. As you can see in the image above, there was a net bearish ebb and flow to the market that would have probably been kind to put options at a clear area of resistance, but nothing set up so I closed things down for the day.

There was an error rendering this rich post.

Tagged: