Current Biases toward Put Options on the EUR/USD

mifune

Posts: 160 ✭✭

January 6, 2015

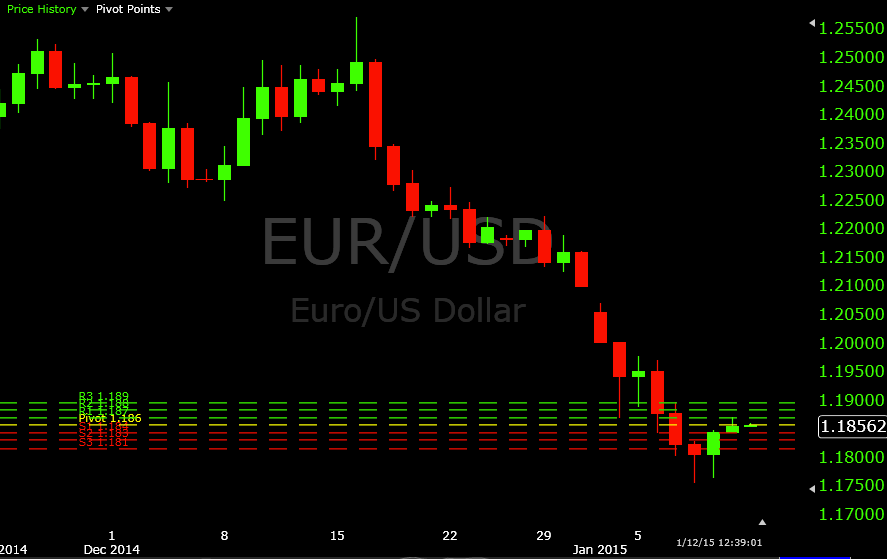

As I've mentioned in my most recent EUR/USD posts, this currency pair is currently in the midst of a pretty significant slide, noticeable both on the daily chart, and from the very recent price action. My current bias on the pair is naturally down, so I prefer put options to calls. I certainly do not exclude call options from consideration and some notable upswings in price will and do happen. But for the time being, I'm simply more comfortable in taking puts due to the ongoing trend in the EUR/USD.

During the latter part of the week (January 5-9), the EUR/USD showed a bit of slight rebound. At least temporarily, as I write this from the morning of Monday, January 12, price found a bit of support along 1.1800. A bullish engulfing candle formed Friday on the daily chart including all of the price data from January 9.

In terms of textbook price action teaching, a candle bullish (green/rising) candle that engulfs or takes up the entirety of the previous candle can generally be considered a potential – even a reliable – reversal signal. But it's way too premature to be making any predictions about the EUR/USD based on that alone. The simple main takeaway is that put options may be better suited for the current environment, although quality call options are certainly worth taking should they present themselves.

As for Tuesday's (January 6) trading... Initially, I wasn't getting anything to setup well in the early going of this trading day. I was looking at the pivot level as a logical spot for a put option. But the trade itself never set up and passed through the level on a strong bullish candle just shy of 4AM EST (see image below). After this break of pivot, 1.2000 was about fifty pips away, which could have been a realistic target and would likely see some good reaction that could prove useful for put option setups. Yet less than a half-hour later, price fell back below pivot and began targeting support 1 right around the 1.1900 level.

As stated, I was certainly willing to take a call option should it set up properly. Buying in the market certainly wasn't dead with the short break of pivot that was seen earlier. Moreover, that level had acted as support for a brief fifteen-minute period. Accordingly, support 1 was fairly likely to act similarly, especially with 1.1900 possibly acting as a sort of psychological barrier, if only slightly.

While this did hold true as expected, any call option setup didn't display itself as I would have preferred. I trade based on rejections of levels to ascertain whether a price is robust enough as a support or resistance area, followed by a trade entry at the level in question. So while support 1 held and even saw a 20-pip jump above it shortly after 6AM EST, this is simply an instance where my trade entry rules didn't properly align with the situation.

As a result, no trades were taken on this pair during this particular day.

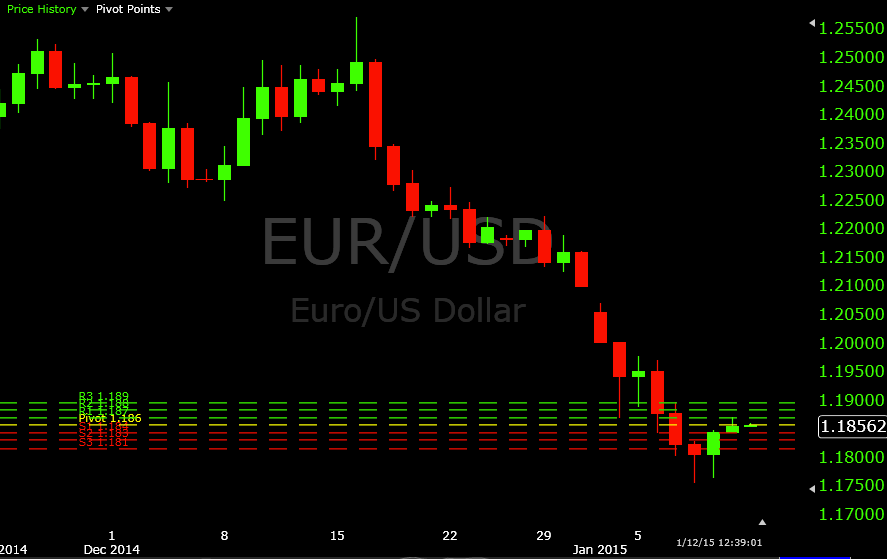

As I've mentioned in my most recent EUR/USD posts, this currency pair is currently in the midst of a pretty significant slide, noticeable both on the daily chart, and from the very recent price action. My current bias on the pair is naturally down, so I prefer put options to calls. I certainly do not exclude call options from consideration and some notable upswings in price will and do happen. But for the time being, I'm simply more comfortable in taking puts due to the ongoing trend in the EUR/USD.

During the latter part of the week (January 5-9), the EUR/USD showed a bit of slight rebound. At least temporarily, as I write this from the morning of Monday, January 12, price found a bit of support along 1.1800. A bullish engulfing candle formed Friday on the daily chart including all of the price data from January 9.

In terms of textbook price action teaching, a candle bullish (green/rising) candle that engulfs or takes up the entirety of the previous candle can generally be considered a potential – even a reliable – reversal signal. But it's way too premature to be making any predictions about the EUR/USD based on that alone. The simple main takeaway is that put options may be better suited for the current environment, although quality call options are certainly worth taking should they present themselves.

As for Tuesday's (January 6) trading... Initially, I wasn't getting anything to setup well in the early going of this trading day. I was looking at the pivot level as a logical spot for a put option. But the trade itself never set up and passed through the level on a strong bullish candle just shy of 4AM EST (see image below). After this break of pivot, 1.2000 was about fifty pips away, which could have been a realistic target and would likely see some good reaction that could prove useful for put option setups. Yet less than a half-hour later, price fell back below pivot and began targeting support 1 right around the 1.1900 level.

As stated, I was certainly willing to take a call option should it set up properly. Buying in the market certainly wasn't dead with the short break of pivot that was seen earlier. Moreover, that level had acted as support for a brief fifteen-minute period. Accordingly, support 1 was fairly likely to act similarly, especially with 1.1900 possibly acting as a sort of psychological barrier, if only slightly.

While this did hold true as expected, any call option setup didn't display itself as I would have preferred. I trade based on rejections of levels to ascertain whether a price is robust enough as a support or resistance area, followed by a trade entry at the level in question. So while support 1 held and even saw a 20-pip jump above it shortly after 6AM EST, this is simply an instance where my trade entry rules didn't properly align with the situation.

As a result, no trades were taken on this pair during this particular day.

There was an error rendering this rich post.