mytradelook live signals/trades/education for free

Comments

-

Tomorrow Monday 10 Feb,2014 (only for tomorrow) the trading session will be during the US session, 1 hour after the opening of Wall St. The other days will be during the London session, normally.

Thank you.

Kind Regards,

Kostasze -

-

10 Feb (One ITM binary trade & 1 Spot trade(20,5 PIPS gain), the trades/signals were given/shared for free)

EUR/USD PUT - ITM

Here you can see the 30min chart. I took a PUT binary option contract (put arrow) with 30 minutes expiry time. In this chart you can see that the price hit the high of the day (HOD). Very long bullish candle with buying climax and a small rejection at the previous resistance area in an overbought condition.

Another clue for this trade came from the 5min chart.

I want you to see the blue rectangle. The price is moving up to the HOD (according to the 30min chart) but as you can see at the blue rectangle we have a stopping volume pattern in which the bearish volume is bigger than the bullish.

-Should you take a trade after the pattern based on the 5min chart?

No. This is just an evidence that the bears were starting to have strength. The right place for the trade was the HOD at the 30min chart above and the volume gave us an extra clue that the reversal at that level was possible. As it happened finally, we had a nice 3 PIPS drop (7 PIPS the biggest drop during the 30mins) and the trade was a nice ITM.

Spot trade

10 Feb

asset: USD/CHF

spread:1,6 pips (FXCM)

sell

SL: 10 pips

Gain: 20,5 PIPS

Return: 200% (based on the money I risked for this trade (SL) )

As I posted above in the morning I closed this spot trade with a 20,5 PIPS profit.

Here is the final chart the time I closed the trade

There was already a nice downtrend and the price came to the triple EMA. It couldn’t overcome that area and also we have some nice rejections with buying climax below the 89 EMA (Notice the buying climax pin bar). The SL order is a little bit above the 89 EMA near the previous broken support (around 10pips), Finally we had a drop and I banked 20,5 PIPS in about an hour.

Why did I closed there?

Because as I said above there was already a downtrend (we weren’t a the beginning of a new downtrend and the space for profit was specific). Also, if you notice the bearish volume was decreasing.

Another clue for this trade was the daily setup.

The price was moving to the last support and it was very possible to come to the area to test the level. As it happened.

more details, screenshots, charts

http://mytradelook.com/

Kind Regards,

Kostasze -

11 Feb

EUR/GBP PUT – ITM

We were in a downtrend the last hours and here you can see the 30min chart. The price came back to the EMAs (50-61.8% Fibonacci retracement level) and it couldn’t break through, we have a nice rejection. I took a PUT binary option contract (put arrow) with 30 minutes expiry time.

Another clue was came from the 5min chart.

Look at the blue rectangle. We have a nice pin bar with buying climax which was rejected by the triple EMA.

Finally, we had a nice 5pips drop and the trade was ITM.

more details, screenshots

http://mytradelook.com/forums/topic/live-trades-feb-2014/

Best,

Kostasze -

12 Feb

AUD/USD PUT – ITM

Here you can see the 15min chart. A new downtrend was forming that time and I took a put with 30 minutes expiry time (put arrow). We had some nice lower highs and the price had difficulties to broke the EMAs. Also, at the 5min chart we had a nice stopping volume pattern some minutes before our entry. Finally, we had a drop and the trade was a nice ITM.

more details, screenshots

http://mytradelook.com/forums/topic/live-trades-feb-2014/ -

-

13 Feb (one ITM binary trade and almost 100PIPS banked last night at Spot)

EUR/USD PUT – ITM

Here you can see the 15min chart. I took a put binary option contract with 30 minutes expiry time (put arrow). Price hit previous day highs and have a nice pin bar and a nice fake breakout as well. The trade was ITM.

[b]SPOT TRADES[/b]

Yesterday I posted this NZD/USD analysis for the members of mytradelook.com

A new dowtrend is forming for NZD/USD. Lower Highs, the price broke the EMAs and is moving below the. Also, much bearish volume. There was an opportunity at the first stopping volume pattern (it would have gain around 20pips right now but I missed it). If the trend is strong we should see a come back to the EMAs in a lower high spot with Stopping volume pattern or volume with beairsh intentions. If these criteria will meet the blue rectangle could be a next possible entry for short positions.

Finally the price acted as predicted

more details, screenshots

http://mytradelook.com/forums/topic/live-trades-feb-2014/

http://mytradelook.com/forums/topic/forex-trades-2014/

Kind Regards,

Kostasze -

14 Feb

USD/CHF PUT – ITM

We were in a downtrend and here you can see the 15min chart. The pricee hit the 89 EMA and we have bearish volume and a nice rejection (doji candle). I took a put binary option contract with 30 minutes expiry time. Finally, we had a nice drop around 10PIPS and the trade ended deep ITM.

We had a nice week with 100% success rate for binary options and around +120 PIPS banked in FX. (all the trades/signals were given/shared for free)

Have a great weekend!

Kind Regards,

Kostasze -

mytradelook.com : 470 total members, over 300 active!

I' m happy to announce that our community is growing, mytradelook.com has now 470 members and more than 300 of them are active members and real-time traders!

Kind Regards,

Kostasze -

Hello,

I want to inform you that there is a server's issue and you can't access the site. So, we have to wait the hosting company.

Thank you for your patience.

Kind Regards,

Kostasze

######### FIXED ##########

The server problem was fixed, I took a trade in the morning which was ITM but unfortunately I couldn't share it/give the signal due to the above problem . I'll post the trade and I'll reply to your messages asap.

Thank you! -

Hello everyone,

today morning there was a server issue(GoDaddy) and the site was not available. Now the server issue fixed. I took an ITM binary trade today but I couldn't share it/give the signal because of the server issue. If there will be a similar issue in the future you can always visit mytradelook.com threads (BOD, BON, T2W) to look for updates or a message of mine. Thank you for your patience!

17 Feb

AUD/USD PUT - ITM

There was a nice downtrend and a nice reversal (with a pin bar) at the try of the price to break the EMAs. I took a PUT binary Option contract with 30mins expiry time (put arrow). Also, at the 5min chart there was a selling climax candle below the EMAs. Finally, we had a nice 5pips drop and the trade ended ITM.

Kind Regards,

Kostasze -

18 Feb

USD/JPY PUT – ITM

Here you can see the 15min chart. As you can see we were in a downtrend. The price couldn’t break the EMAs. I took a PUT binary option contract with 30 minutes expiry time.

Also, at the 5min chart the price had difficulties to break the triple EMA and there was also low volume below it. We had a 4-5pips drop and the trade ended ITM.

more details, screenshots

http://mytradelook.com/forums/topic/live-trades-feb-2014/page/2/#post-1435

Kind Regards,

Kostasze -

Dukascopy: The Swiss FX Bank enters the BO industry

more details:

http://mytradelook.com/dukascopy-the-swiss-fx-bank-enters-the-bo-industry/ -

19 Feb

AUD/USD PUT – ITM

Here you can see the 30min chart. We had an extended uptrend in the morning which broke the short-term resistances from the lower TFs. There is a strong resistance from the previous day in which we have a nice rejection in an overbought condition. I took a PUT contract with 30 minutes expiry time which was ITM.

more details, screenshots

http://mytradelook.com/forums/topic/live-trades-feb-2014/page/2/#post-1444

Best,

Kostasze -

20 Feb

USD/JPY PUT – OTM

Today we had the first OTM of the month. Here you can see the 30min chart. It was a good setup. There was a strong downtrend the whole day, the price hit the trendline and was rejected by the EMAs after a fake break. However, the price moved higher and the trade ended OTM. I still remain bearish on FX (EUR/GBP from last night).

Kind Regards,

Kostasze -

21 Feb

USD/JPY PUT – ITM

There was a nice downtrend and as you can see at the 30min chart the price had difficulties to break the EMAs (50-61.8% Fib retracement level). Also, at the 5min chart the price had difficulties to break the triple 34 EMA and the selling climax candle before the price reach the level show us that there are sellers and a drop it was possible. Finally, we had a nice drop and the trade ended deep ITM.

80% success rate for the week after two weeks with 100%, all the trades/signals were given/shared for free.

more details, screenshots

http://mytradelook.com/forums/topic/live-trades-feb-2014/page/2/#post-1457

Have a great weekend!

Kind Regards,

Kostasze -

Latest News:

-CySEC: New warning about CedarFinance

( http://mytradelook.com/cysec-new-warning-about-cedarfinance/ )

-Price Action Patterns

( http://mytradelook.com/price-action-patterns/ )

-Alpari: Back to Binaries

( http://mytradelook.com/alpari-back-to-binaries/ ) -

24 Feb

USD/CHF PUT – ITM

Here you can see the 30min chart. The price had difficulties to break the EMAs. Notice the nice wick. Also, at the 5min chart we had a rejection below the 89 EMA. I took a PUT binary option contract with 30 minutes expiry time which ended ITM.

more details, screenshots

http://mytradelook.com/forums/topic/live-trades-feb-2014/page/2/

Kind Regards,

Kostasze -

This month is over and it was a nice one for us.

Binary Options : 80% success rate

Forex: around 200pips banked (made the first two weeks, the other two I opened three positions but I closed them early with a tiny profit afraid of the news those days, however at those trades the trends finally came NZD/USD, USD/CAD and I you kept them you earned more pips)

You can see the trades and their explanations here

http://mytradelook.com/forums/topic/live-trades-feb-2014/

http://mytradelook.com/forums/topic/forex-trades-2014/

Every single signal/trade was given for free to the members of mytradelook.com

Have a nice weekend everyone!

Kind Regards,

Kostasze -

Great job!

-

Thank you buddy!

-

mytradelook.com latest news:

- Bitcoin Meltdown: $475 million lost. Be aware. ( http://mytradelook.com/bitcoin-meltdown-475-million-lost-be-aware/ )

- How international customers will be able to trade in Nadex? ( http://mytradelook.com/how-international-customers-will-be-able-to-trade-in-nadex/ )

- mytradelook.com : 80% success rate for February ( http://mytradelook.com/mytradelook-com-80-success-rate-for-february/ )

- Keltner Channels ( http://mytradelook.com/keltner-channels/ ) -

3 Mar

AUD/USD PUT – ITM

Here you can see the 30min chart. Began to form a downtrend and I took a PUT binary option contract with 30min expiry time (put arrow). 1 hour ago the price broke the EMAs and no we have a come back with a rejection (the price can’t break up). The 15min chart had a similar picture. Finally, we had a 8 PIPS drop and the trade ended deep ITM.

more details,screenshots

http://mytradelook.com/forums/topic/live-trades-mar-2014/

Best,

Kostasze -

4 Mar

EUR/JPY PUT – ITM

After a period of time in which we had a slow market you can see a long bullish candle near HOD (high of the day). Here you can see the 30min chart. I took a PUT binary options contract with 30 minutes expiry time (put arrow). The price hit the previous resistance level (white rectangle), we had a fake breakout and finally it closed below the resistance. At the next candle after a new try to break the level the price was rejected and the trade ened ITM.

At the 5min chart notice the buying climax and the rejections below the level.

PS: As I wrote today in the chat, be careful the markets can become weird these days because of the commotion in Europe, note the behavior of metals, oil, gas.

more details, screenshots

http://mytradelook.com/forums/topic/live-trades-mar-2014/

Kind Regards,

Kostasze -

5 Mar

EUR/JPY PUT – ITM

After a strong uptrend the whole day we have a nice resistance with a stopping volume pattern. When the price came back to test it we have an increasing bearish volume (selling climax also at the reistance). I took a PUT binary options contract with 30 minutes expiry time. Finally, we had a nice drop around 7-8 PIPS and the trade ended deep ITM.

more details, screenshots

http://mytradelook.com/forums/topic/live-trades-mar-2014/#post-1550

Kind Regards,

Kostasze -

Binary Options: 80% success rate for the week

all the signals/trades were given/shared for free

Here you can see the trades and their explanations.

http://mytradelook.com/forums/topic/live-trades-mar-2014/

Also,I want to inform you that we have a new trading room which is faster and bigger (more than 100 traders can be here now, the same time)

Latest News:

- mytradelook.com: New trading room! Faster and larger! ( http://mytradelook.com/mytradelook-com-new-trading-room-faster-and-larger/ )

- IronFX Pays Nearly 3 Million Euros to Sponsor FC Barcelona ( http://mytradelook.com/ironfx-pays-nearly-3-million-euros-to-sponsor-fc-barcelona/ )

- OptionBit: €5.000 Fine by CySec ( http://mytradelook.com/optionbit-e5-000-fine-by-cysec/ )

- Italian Regulator Warning against BO brokers ( http://mytradelook.com/italian-regulator-warning-against-bo-brokers/ )

Kind Regards,

Kostasze -

10 Mar

USD/CAD PUT – ITM

Here you can see the 30min chart.There was a downtrend the whole morning. The news pushed the price up and then we have a nice pin bar below the EMAs (notice the nice rejection). I took a PUT binary option contract with 30minutes expiry time (put arrow). After a fake break of the EMAs the trade ended ITM.

Kind Regards,

Kostasze -

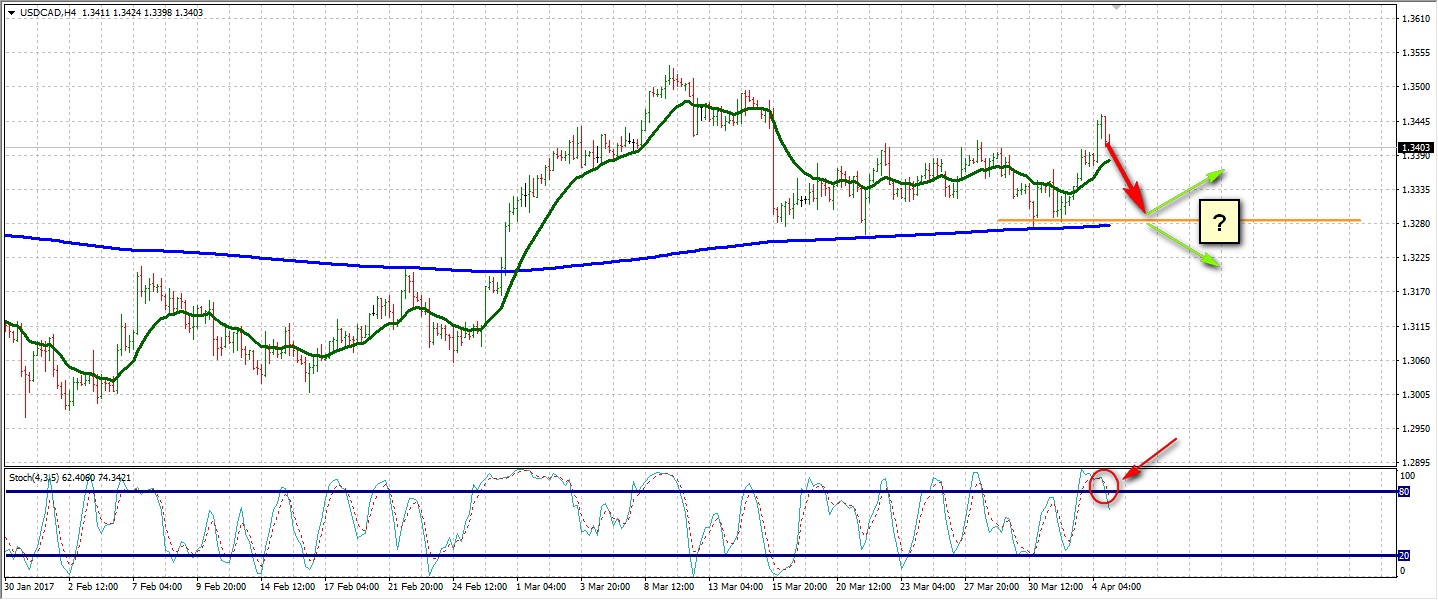

Right now, I can’t see the entrance for opening a deal on the asset, so I’ll wait until the price reaches one of the levels, and then I’ll make a decision.