economic calledars, some are different

Im confused about economic callendars and i hope someone can clear my confusion.

Here will be 3 different econimic callendars and all 3 have the same news but they show different volatility. So which one is the best of these 3 and which should i use?

All are Tuesday, February 14, 2017

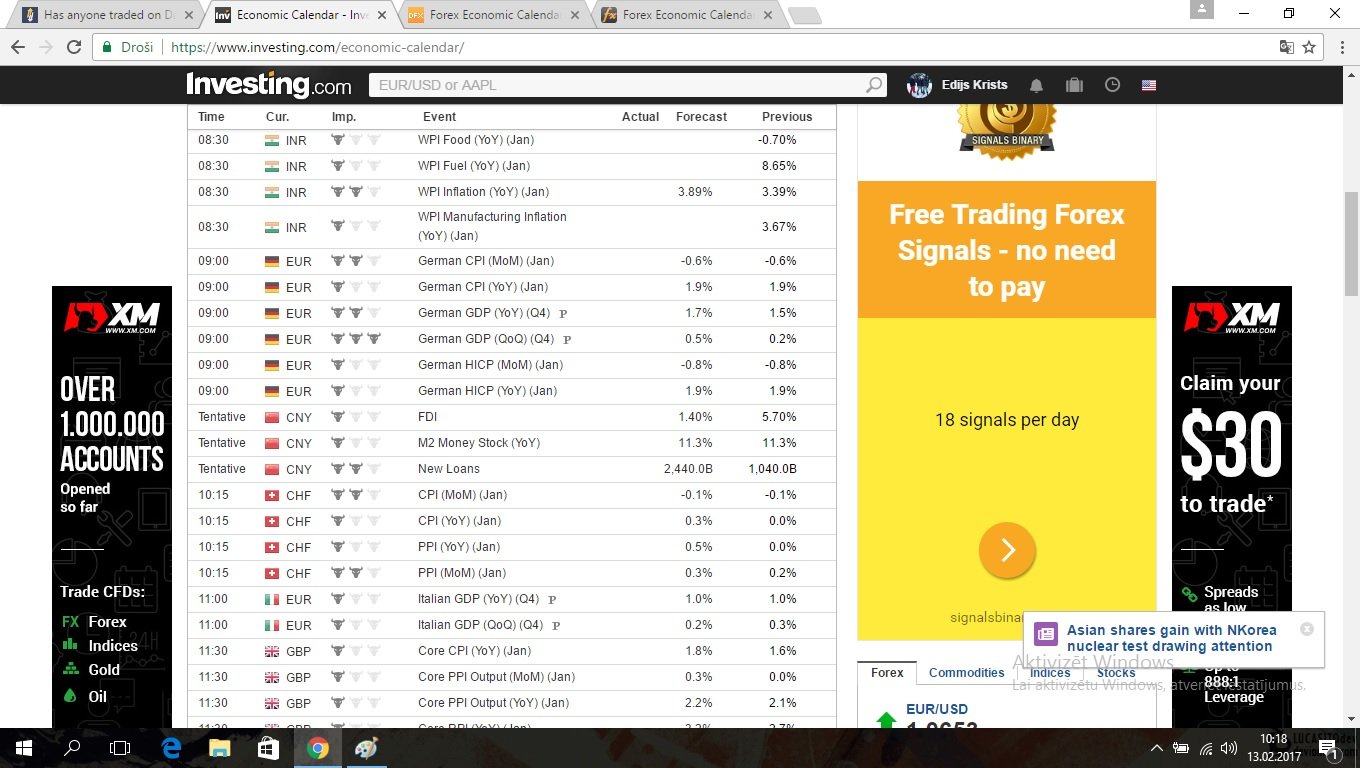

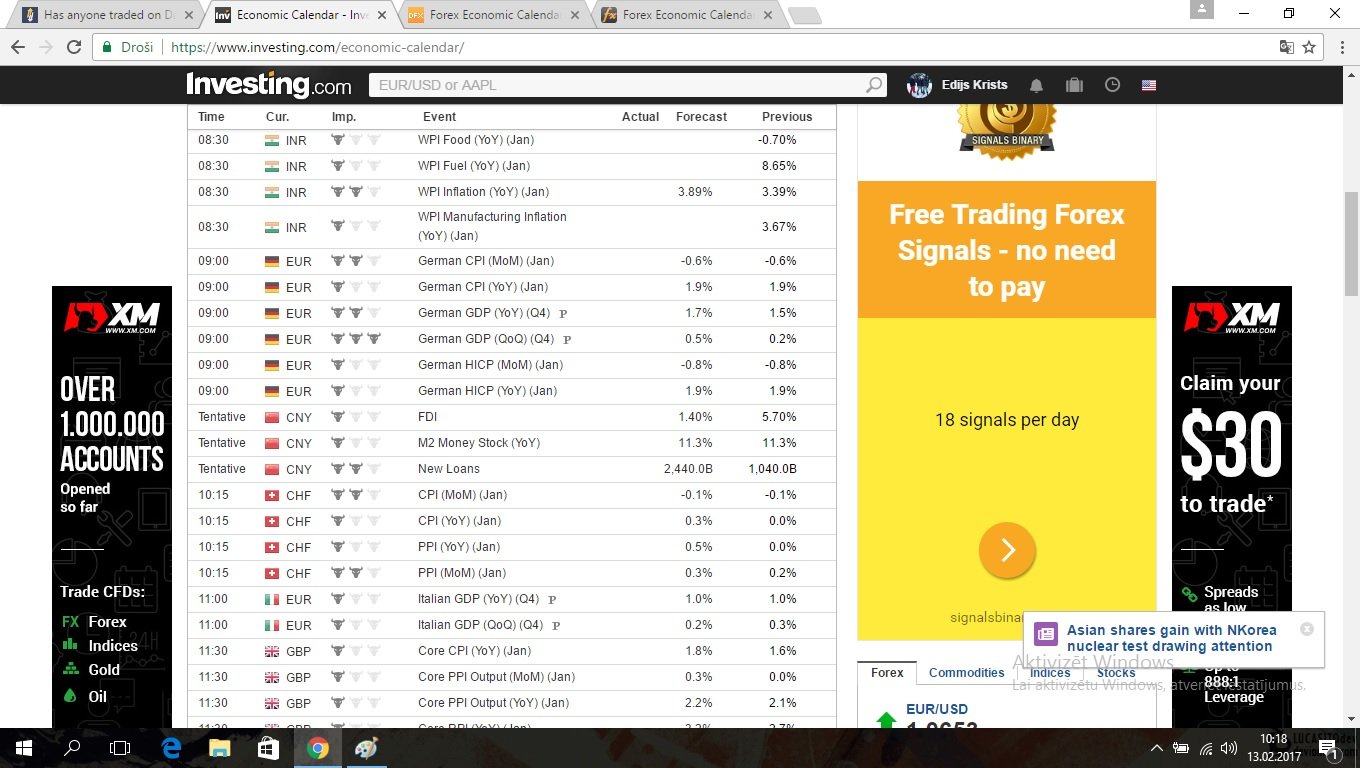

So the first is investing.com economic callendar and the news are German GDP (QoQ) (Q4) and German GDP (YoY) (Q4) as you see in picture investing shows that high volatility is on QoQ and not on YoY

Next on dailyfx.com economic callendar on the same news they show that YoY has high volatility not QoQ as you see in picture bellow.

And the last one is myfxbook.com economic callendar and they show that none of these news are high volatility. And theses german news are not the only ones that they show different.

So i want to know which one i have to watch and wich one shows the right volatility?

Here will be 3 different econimic callendars and all 3 have the same news but they show different volatility. So which one is the best of these 3 and which should i use?

All are Tuesday, February 14, 2017

So the first is investing.com economic callendar and the news are German GDP (QoQ) (Q4) and German GDP (YoY) (Q4) as you see in picture investing shows that high volatility is on QoQ and not on YoY

Next on dailyfx.com economic callendar on the same news they show that YoY has high volatility not QoQ as you see in picture bellow.

And the last one is myfxbook.com economic callendar and they show that none of these news are high volatility. And theses german news are not the only ones that they show different.

So i want to know which one i have to watch and wich one shows the right volatility?

Comments

-

well my friend each of those calendars is right in terms of what's coming up, the volatility thing is totally subjective. No one can ever know which or what or why data moves the market, at best it is an educated guess which is why we call it speculating. You'll just have to get a fell for which data affects your assets, and for how it affects it, keep up with it so you know when it is good or bad or indifferent... make sense?

-

ok, thanks! Makes sense.The_Geek_MH said:well my friend each of those calendars is right in terms of what's coming up, the volatility thing is totally subjective. No one can ever know which or what or why data moves the market, at best it is an educated guess which is why we call it speculating. You'll just have to get a fell for which data affects your assets, and for how it affects it, keep up with it so you know when it is good or bad or indifferent... make sense?

-

Okay, very good quesion here, but why do people actually makes this calendars to see what really ? If all this so volatile and have something like that different each time ? I just wanted to dig that thread from grave really. Please let me know if you can;) I use guesses yes;)