Zombie Zone Trading

Comments

-

OTM #2

Nov 29, 06:56:57 GBP/USD 1.63342 1.63350 Nov 29, 07:05:00 $5.00 75% $8.75 OTM

And, the market again taunts me just seconds later....

-

OTM #3

Gold really took off in the wrong direction against me. I was looking for a counter trend trade, and I had a nice little red candle, until I placed my trade...

Nov 29, 07:07:31 GOLD 1246.74 1248.00 Nov 29, 07:15:00 $5.00 80% $9.00 otm -

I took a leap of faith and joined Bryan Mac's "Trading Axis" group. He has started a few great threads on this forum.

I felt that trading and watching others trade the exact same system in a live group setting would give me the consistent success I strive for.

I am going through my learning curve, and I have my first ITM to post. I'm using a demo account for a few days.

Here, price moved up and hit resistance. I had overbought confluence within the indicators, and won the trade.

Dec 02, 22:19:22 GBP/USD 1.63649 1.63639 Dec 02, 22:25:00 ¢10.00 70% ¢17.00 -

Dec 03, 06:24:09 USD/JPY 102.674 102.693 Dec 03, 06:30:00 $1.00 70% $1.70

I am still learning this new system, but I had to use real money. I hate using a demo account. I feel like I will be taking "Less than optimal" trades while on demo. So even at $1 per trade, I will still trade a lot more serious. -

ITM#2 for Tuesday. Price found support from that pivot level.

Dec 03, 06:49:05 EUR/GBP 0.82587 0.82620 Dec 03, 06:55:00 $1.00 70% $1.70

-

I have one ATM, and one ITM to share today.

This ATM example, the price just stalled out. It drifted sideways, but at least I didn't lose!

Dec 04, 21:58:00 EUR/USD 1.35904 1.35904 Dec 04, 22:05:00 $1.00 72% $1.72 -

This ITM was very close. So close, that price started shooting up before I could save the screenshot!

Dec 04, 22:51:24 USD/JPY 102.334 102.322 Dec 04, 23:00:00 $5.00 80% $9.00 -

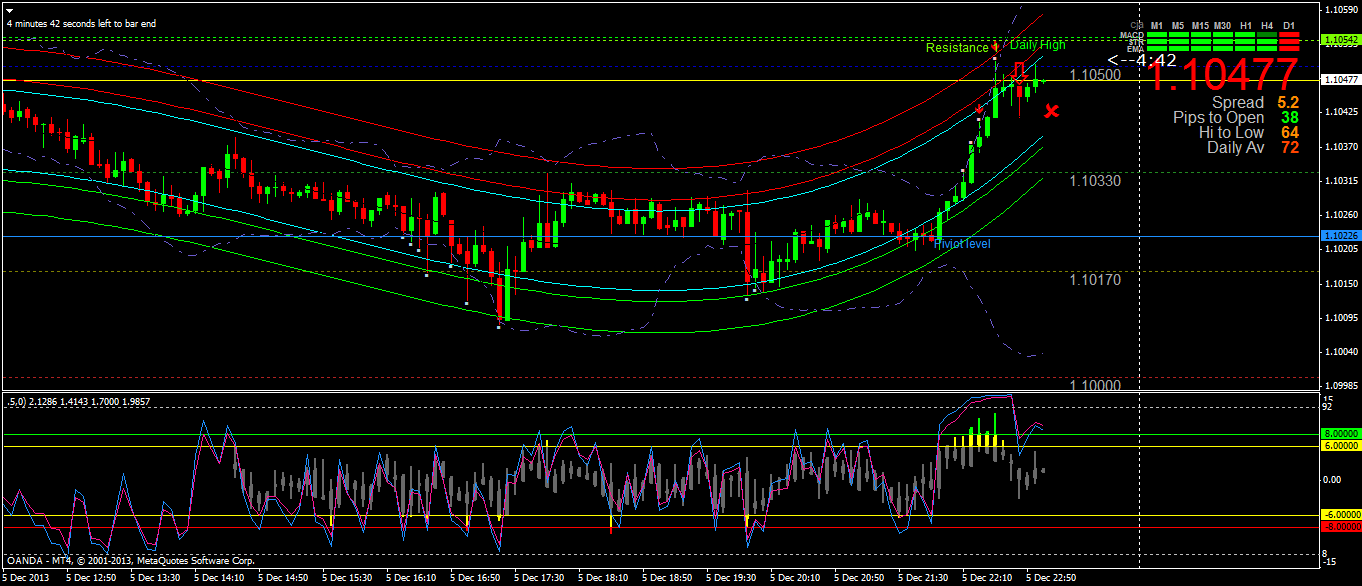

Clearly, I am still getting used to this new system. Here, I was looking for price to drop down from that resistance level. My Value chart at the bottom with the RSI was dropping,too. I thought I had a good trade upon entry, but the bulls were not done fighting to push up the price.

Dec 05, 22:42:50 AUD/NZD 1.10482 1.10502 Dec 05, 23:00:00 $4.00 85% $7.40 OTM -

Gold got the best of me this morning. I was looking for a reversal at that blue pivot line, but price continued to fall.

-

I did find a nice rejection from a resistance level on AUD/USD. The RSI was falling at a sharp angle,too.

Dec 06, 07:26:36 AUD/USD 0.90714 0.90676 Dec 06, 07:35:00 $1.00 75% $1.75 -

December sure can be slow. I do not have a trade today. But I did catch a winner Sunday night. The trading axis system looks for confluence with multiple signals before a trade is taken. In this trade, price reached outside the aqua level in the channel, the VC indicator at the bottom is showing oversold, and price was hitting a pivot point.

Dec 08, 20:24:56 USD/JPY 102.926 102.936 Dec 08, 20:30:00 $5.00 70% $8.50 -

Here is a trade on gold that did not work out. I jumped into the trade one candle too soon. I was looking at an imaginary resistance level, but price moved on up to the real resistance. Also, down on the VC indocator, the system works better if the RSI and the VC gray candles turn green and get close to or touch the 92 level for a put trade. The biger hollow red arrow is my entry, the solid little arrow is a trade alert that sometimes pops up to indicate a trade opportunity is coming.

-

But I also have a winner to show, everything lined up according to plan on this one. This was a moving average crossover trade, like I used to take on my original system rules.

Dec 10, 07:54:37 GBP/USD 1.64424 1.64459 Dec 10, 08:00:00 $5.00 80% $9.00 -

Two for Tuesday

This chart looks like a close call, and a very tight win, but marketsworld gave me a favorable strike price. I tried to get my entry as close as I could at the top of that green candle.

Dec 11, 07:09:15 AUD/JPY 93.4855 93.4780 Dec 11, 07:15:00 $5.00 70% $8.50 -

Second winner was a GBP/USD trade.

I found price hitting a resistance level.

Dec 11, 07:38:27 GBP/USD 1.63752 1.63750 Dec 11, 07:45:00 $5.00 95% $9.75

And WOW! A 95% profit on that one! I hope Marketsworld gives out of those! -

I have a picture perfect trade according to all of my trading rules. I'm working to get back to that zombie state. Just trade, don't over analyze.

Dec 12, 07:29:50 EUR/GBP 0.83956 0.83973 Dec 12, 07:35:00 $1.00 70% $1.70 -

Here is one beautiful trade before Friday morning USD news release in 40 minutes.

I found price hitting a support level. I entered the trade right on that line of support at 103.500. The entry price was my key to winning 6 minutes later.

Enjoy the weekend!

Dec 13, 07:33:11 USD/JPY 103.512 103.530 Dec 13, 07:40:00 $1.00 70% $1.70

-

Alright traders, I really like this new system. The more I get over my old tendencies and follow the rules, the better it works.

With that said, I am still learning the intricacies of it. I have a winner and a loser today.

First, the loser. I took a put option when the daily high was lined up with the big red arrow showing my entry. I forgot that the daily high is only strong if price touches it two or three times. As you can see, price pushed the daily high level up and up, and I lost.

Dec 16, 07:24:37 GBP/USD 1.63347 1.63450 Dec 16, 07:30:00 $1.00 70% $1.70 -

On the other trade, I found confluence in multiple indicators to show that price was oversold.. It was textbook perfect, and I won easily.

Dec 16, 07:39:10 GOLD 1233.95 1233.15 Dec 16, 07:45:00 $2.00 70% $3.40 -

Patience pays off. The market is a little slow this time of year, but I still found a nice win this morning. Price found support at that prev weekly low yellow dashed line. The other indicators looked good for a reversal off of support, and I took the trade. The two RSI lines I have on the bottom make for a stronger signal when they move closer together, but I still liked the trade. That line of support held price a few times already.

Dec 18, 07:13:24 AUD/NZD 1.07912 1.07926 Dec 18, 07:20:00 $5.00 70% $8.50 -

I had another nice trade with the Trading Axis system again today. Price hit resistance and I took the trade. My indicators showed overbought,too.

Dec 19, 07:44:58 USD/JPY 104.179 104.170 Dec 19, 07:50:00 $8.00 72% $13.76 -

Nice BO. TA is a beauty - cant wait for TA 3. Have a nice x-mas time.

-

Looks good, your timing is perfect. Is it your own meta-trader file?

Would be nice to have one

So how much have you made with this system now?

You offer a signal service?

Keep the info coming :

Profit in 60 second website is a SCAM! -

I forced a trade on gold today. It was a close one. Price was dropping pretty hard, but I saw some support happening at a fib level. I got lucky, but in the future, I should stay away from "waterfall" moves when candles are all one color. Price dropped so fast after I won, I had to wait another minute to get a screenshot to show a winning candle. It turned green for a moment, and I saved the picture. Then continued to drop soon after. Very lucky. I don't want to be lucky, I want to be wise.

Short Term

Gold

20/12/13 07:48

10.00

1194.875

1195.025

20/12/13 07:53

Closed

17.00

This entry was on OptionsXO, instead of MW. So it did not copy and paste as nice as MW. -

Thanks HF. Merry Christmas to you. Maybe I will see you in the Skype room sometime.holyfire_germany said:Nice BO. TA is a beauty - cant wait for TA 3. Have a nice x-mas time.

-

janelundqvist said:

Looks good, your timing is perfect. Is it your own meta-trader file?

Would be nice to have one

So how much have you made with this system now?

You offer a signal service?

Keep the info coming :

All I can say is, check out the system Bryan McAfee put together called Trading Axis. He posts on this forum with the Robin Hood picture. You can then become your own signal service. Have a great weekend!! -

janelundqvist said:

Looks good, your timing is perfect. Is it your own meta-trader file?

Would be nice to have one

So how much have you made with this system now?

You offer a signal service?

Keep the info coming :

As far as income goes, money management is vital. It also must match up with short or long term goals. That will be a little different for everyone. Here is one key to watch for in my posts. An account balance of $2000 can realistically expect to earn a little over $1000 per week by placing just 3 trades per day at $100 each trade.

When my trades reach $100 per trade, you'll have a rough idea of what kind of money I am making. -

I found a nice trade before the holiday slows everything down. Price hit resistance at a whole number level. The trade dropped down and gave me an easy ITM.

gyazo.com/9f670568fa0c34f5f71bea681112590f

I still can't seem to get the image to appear in this forum from OptionsXO. This was a $10 trade, with a $17 return. Ok, see the next post. I think I figured out a way to post my trade records.

-